Summary

MP Materials holds a unique position as the sole producer of rare earth elements within the United States, a strategic advantage that positions them for significant growth. MP shares are down over 20% year-to-date and down over 70% from their March 2022 highs, entirely due to low REE prices and concerns about the slowdown in the electric vehicle market. We believe that the market is overreacting to a short-term development and discounting the value the company stands to create through its building of a magnetic manufacturing business that will achieve higher margins and more stable cash flows than its current mining operations.

What are Rare Earth Elements (REEs)

The REE group includes 17 elements, primarily the 15 lanthanide elements.

Light REE: Lanthanum, Cerium, Praseodymium, and Neodymium.

Medium REE: Samarium, Europium, and Gadolinium

Heavy REE: Terbium, Dysprosium, Holmium, Erbium, Thulium, Ytterbium, and Lutetium.

Two additional elements, Yttrium and Scandium, are often classified as HREE, although they are not lanthanides. The light, medium, and heavy REE mixture will differ depending on the rare earth-bearing mineral. Despite their name, rare earth elements are quite plentiful in the earth’s crust, with Cerium being more abundant than copper. They are called rare earths because they are typically found at concentrations too low to economically mine.

China currently dominates the rare earth element market, with a 75% share of global mining and a 92% share of global refining and processing, split between 100% control of heavy rare earth refining and 85% of light rare earth refining.

The role of rare earth elements in various industries is pivotal, from electric vehicles and wind turbines to consumer technology and aerospace. Their presence in our daily lives is so pervasive that it's hard to overstate their importance in modern society. This widespread and essential use serves as a strong indicator of the potential demand for MP Materials' rare earth elements, further bolstering the company's growth prospects.

Rare Earths Supply & Demand Balances

We think the supply-demand balance for rare earths is starting to improve after a prolonged period of REE price declines starting in 2022. After a surplus of over 6,500 metric tons in 2023, our supply and demand modeling suggests that there will likely be an 800 metric ton deficit in 2024, possibly expanding to 1,500 metric tons in 2025. We believe that the large-scale price decline of the last two years has eliminated a substantial portion of the early-stage projects outside of China that were only feasible at higher prices. Vital Metals, which was developing Canada’s only rare earths mine and a mining prospect in Tanzania, declared bankruptcy in September 2023. There also remains a substantial risk of marginal REE producers like Malaysia and Vietnam banning exports to induce domestic investment in refining and higher-value manufacturing, like what Indonesia successfully did with nickel. We think that it is very likely that within the next year or two, we will see rare earth prices increase to between $8,000 and $10,000 per metric ton.

Mountain Pass Rare Earths Mining Facility

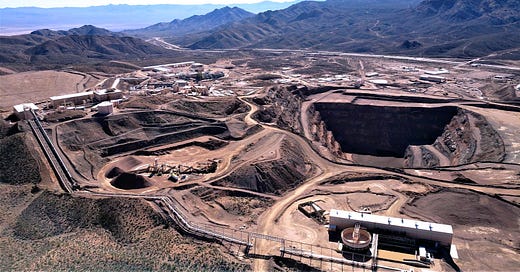

Mountain Pass is MP Materials’ flagship mine. It is the only integrated rare earth mining and processing site in North America, located in the Clark Mountain range in California, only 53 miles from Las Vegas, Nevada.

Mountain Pass is an open pit mine that mainly produces Neodymium and Praseodymium (NDPR) rare earth oxides. The Bastnaesite ore body contains NDPR concentrations between 8% and 12%. After a recent grant from the US Department of Defense, MP has increased production and refining of SEG+, otherwise known as heavy rare earths.

MP’s Development Plan

MP aims to become the only vertically integrated rare earth producer in the Western Hemisphere, mining and refining rare earths and manufacturing permanent magnets. Each stage is designed to produce the cash flows for the development of the next stage, eventually taking MP Materials from a price taker to a price setter, manufacturing high-value permanent magnets,

Stage 1: Production & Beneficiation

The first stage, which started in 2017 and has now been completed, consisted of restarting the Mountain Pass rare earth mine. It is important to remember that while large-scale production at Mountain Pass has been going on since the 1960s when MP Materials took control of the facility in 2017, the mine had been completely shut down since the bankruptcy of the previous owner, Molycorp, in 2015. Stage 1 included bringing online all the crushing, grinding, and flotation infrastructure necessary for the beneficiation process to separate waste minerals from rare earth concentrates. MP Materials has now achieved rare earth oxide (REO) concentrate production 3.5 times greater than the facility’s highest-ever production under prior ownership.

Stage 2: Separation & Refining

Stage 2, starting in the fourth quarter of 2022, consists of separating and refining rare earth concentrates into individual rare earth elements using an oxidizing roasting circuit. Refined rare earth oxides (REC) are a higher-value product and a necessary input to producing NDPR magnets. This stage is expected to be largely completed by the end of Q1 2024.

Stage 3: Magnet Production

The company’s magnet production facility in Fort Worth, Texas, is set to come online in 2025. Production targets are 1,000 MT of rare earth magnets annually or enough magnets for 500,000 electric vehicle motors. The company has already entered into a supply agreement with General Motors (GM) for MP Materials to supply US-sourced and manufactured rare earth magnets. Upon completion of this facility, MP Material will be the only fully integrated producer of rare earth magnets in the Western world.

Catalysts: Deglobalization, Remilitarization and Industrial Policy

Reshoring of Critical Minerals Supply Chains

We think that, with the current trend of continued hostilities with China and further reshoring, we will be entering a period of bifurcation in certain commodity markets, in which commodities' place of origin and carbon footprint will play a more important role in pricing. For example, in the Inflation Reduction Act (IRA), to qualify for certain electric vehicle tax credits, a vehicle must have at least 40% of the critical minerals used in the vehicle mined or extracted in either the United States or a country the US has a free trade agreement with, with the minimum percentage increasing every year. We think it is likely that future tax credits and government subsidies for manufacturing will increasingly depend on the source of critical minerals and their carbon intensity. We expect to see more of this trend in the future.

Remilitarization

A second-order effect of deglobalization is an increase in hostilities and remilitarization. The era of the Pax Americana is over, and governments worldwide will invest more in military procurement. This can already be seen with the increase in military spending throughout countries in Europe as they look to counter Russian aggression while fearing that the United States may not be as reliable a security partner as it once was. REEs are key inputs for many essential military products, from night vision goggles to fighter jet components. China’s current control over the supply of critical minerals is an intolerable risk for countries like the United States. We think that the United States is heavily incentivized to facilitate the further growth of its only domestic source of REEs through further government grants and tax credits, lest the US remain dependent on China for materials essential to its military. MP Materials is positioned to be the supplier of choice for REEs and permanent magnets for the military industrial complexes of NATO.

China

Environmental standards are one of the main reasons for China’s dominance in rare earth mining and refining. China has lower environmental standards for mining than developed countries, which allows it to produce REE at a lower cost than its Western competitors. As history has shown, when a country increases in wealth, its population will have less tolerance for environmental degradation as a trade-off for economic growth. This can be seen as recently as the mid-20th century in North America and Western Europe; the environmental degradation that was deemed acceptable for economic growth would be completely intolerable by modern standards. It was not because we did not know that what we were doing was bad for the environment; it was because the economic growth resulting from the environmental degradation made it a worthy tradeoff. The same thing will eventually happen in China; as the country transitions to a middle-income economy, the population will have less tolerance for pollution. Environmental degradation is only ever a priority for a population once all of its other economic needs are met. China has already had to crack down on some of its most environmentally damaging practices; in 2016, a large-scale government crackdown targeted heavy rare earth producers, which had largely been unregulated or illegal up until then, leading to lower heavy REE production. The trend of avoiding environmental standards in China can already be seen. In 2023, China imported around 8,500 tons of REE per month from Myanmar, Malaysia, Vietnam, and Laos, countries in which Chinese-owned miners can operate unregulated. Even after regulatory crackdowns, though, mining practices in China still have minimal environmental standards in comparison to North America and Europe. We think that over the long term, production costs will increase as more emphasis is placed on environmental standards. This process will likely take decades, but it has the potential to decrease China’s influence in the REE market marginally, putting companies like MP Materials and Lynas in a better position.

Valuation Model

We think the market is undervaluing the company’s long-term potential; MP should be valued as a higher-margin business rather than based on the market price of rare earths. We think that with the current ramping of the stage 2 refining of REE concentrate (REC) into NdPr oxides, the company will be able to achieve higher margins over the next two years than the market is giving the company credit for. Once the construction of the magnetics facility is complete, which we expect will be complete in late 2025 or early 2026, MP will produce substantially higher margins and will see its capital expenditure expense decline significantly, likely allowing the company to finally return cash to shareholders in the form of dividends or buybacks.

The completion of the magnetic facility will fundamentally change the business. It will become a much more stable cash flow-producing company no longer at the whim of commodity price fluctuations.

There are three main drivers for this investment: the timeline for the completion of the magnetic facility, which will substantially reduce annual capex and lead to substantial free cash flow that can be returned to shareholders; the ramp of the stage 2 refining; and the market price of REEs.

In the best-case scenario, if the construction of the magnetics facility and the ramp-up in NdPr oxide refining continue without any delays, and REE pricing increases this year to around $8,000 per metric ton, we think that MP shares should be worth $63, an over 300% rise from where they currently trade.

Our base case shows reasonable delays in the construction of the magnetic facility, possibly pushing back completion by one or two quarters, a slow ramp in NdPr oxide production, and a REE price of around $6,000 per metric ton. We think MP shares are still worth $46, which is over a 200% increase from the current share price.

In our bear case analysis, we have valued MP based solely on its current operations, the mining and refining of rare earth concentrates, and NdPr oxide. We have excluded the magnetic facility operations from our valuation. Although this scenario is unrealistic — as the magnetic facility is almost complete — it helps demonstrate that, even if MP is valued only as a REE miner, the market is still undervaluing the company based on its potential to benefit from REE price increases. We believe that if MP shares were valued in this way, they would be worth between $20-$25 per share.

For more information about Berman Capital Group’s investment management services or our research, contact us at info@bermancapitalgroupllc.com or see our website.