Summary

Borr Drilling (BORR) is an offshore oil and gas drilling company operating 24 modern spec jack-up rigs worldwide, 22 operating and two currently under construction slated to come online in Q4 2024 and Q1 2025.

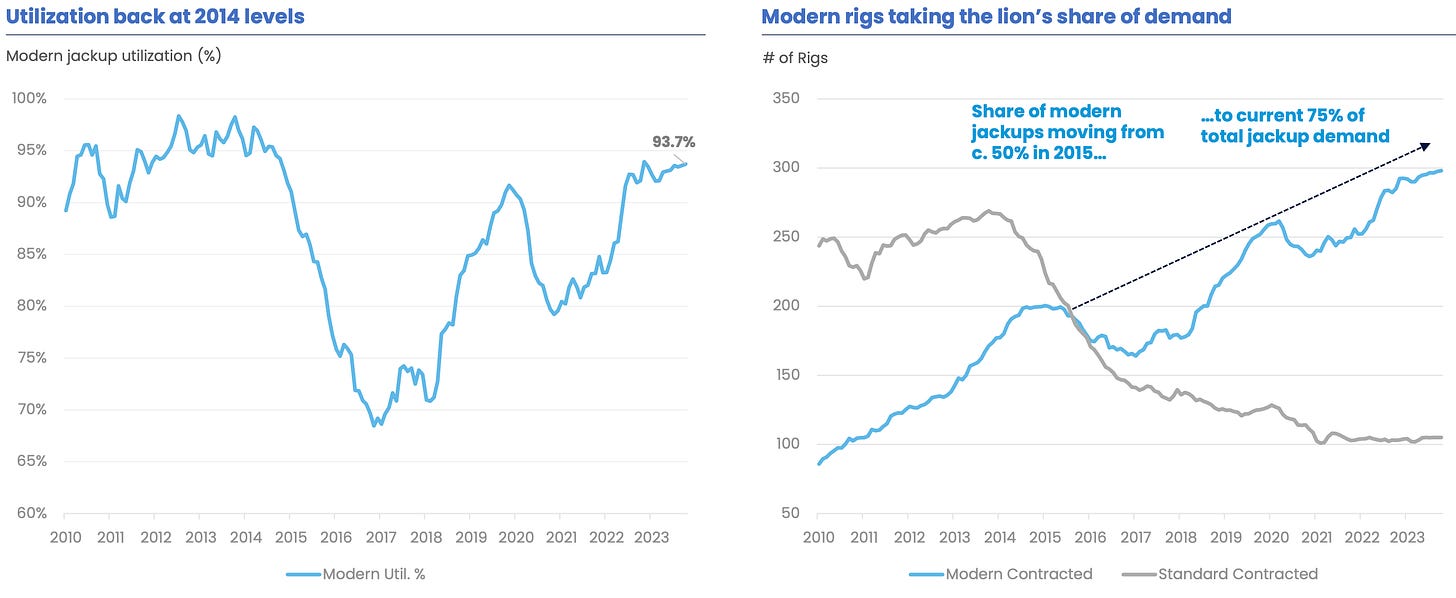

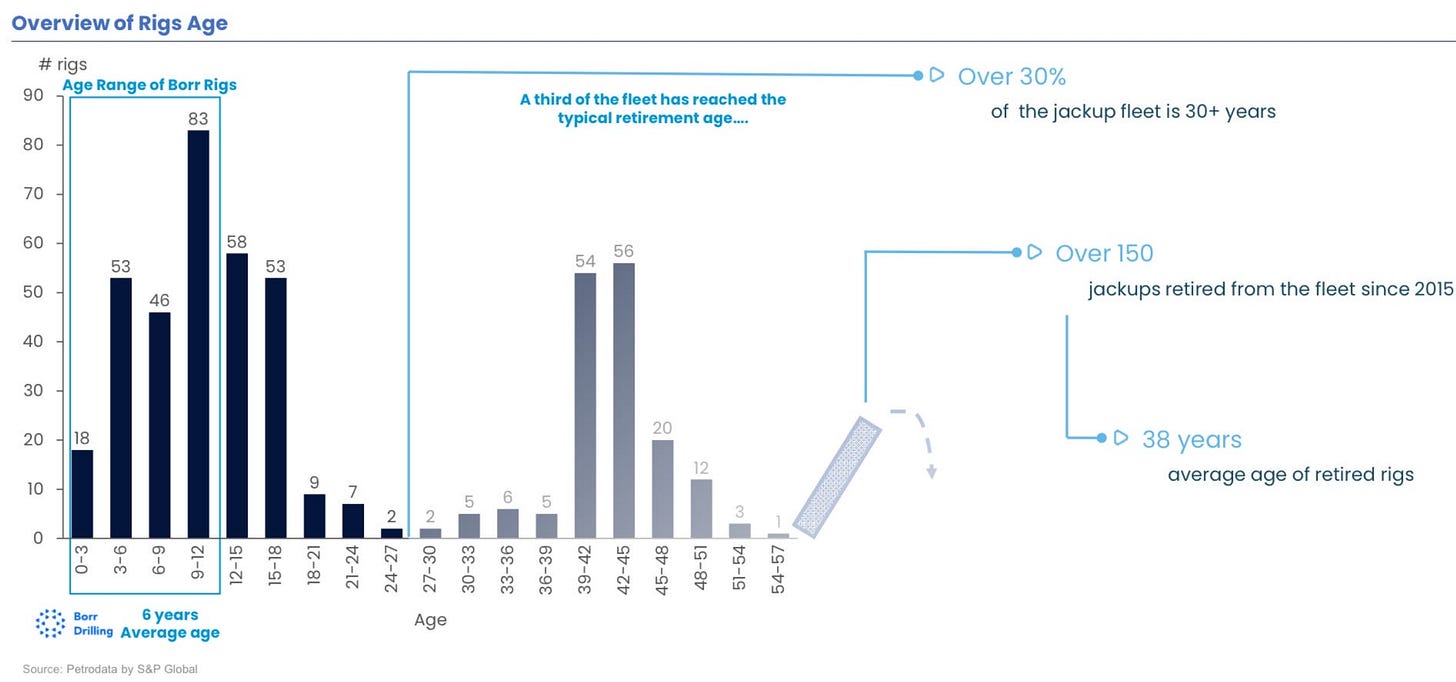

Borr stands to benefit from the current offshore oil and gas development cycle. The current global jack-up fleet is aging, and extreme underinvestment from the bottom of the cycle and a new-build order book at a 20-year low of only 3% of the global fleet means that there are not enough newly built rigs to replace the aging ones that are about to be retired. Newly-built rigs require three years to be built before they enter service, and day rates that would make new-build rigs economical would require day rates at least 40% higher than where they currently stand. With rig utilization already at 93% and the only pressure release valve for day rates being either an economic cataclysm--so severe that all offshore development would be halted--or day rates increasing to at least $230K/day, it is difficult to see a high-probability scenario in which day rates do not continue to trend higher from here.

Borr Drilling’s fleet of 22 modern spec rigs is the youngest fleet in operation, providing it with the lowest breakeven in the industry and allowing it to generate significant free cash flow as day rates go higher. We believe that by 2027, the company could generate almost $1 billion in free cash flow annually at day rates of $230K/day. Borr Drilling could be worth $30 per share by 2027, which would constitute an almost 360% increase in the share price from where the stock is currently trading.

What are Jack-up Rigs?

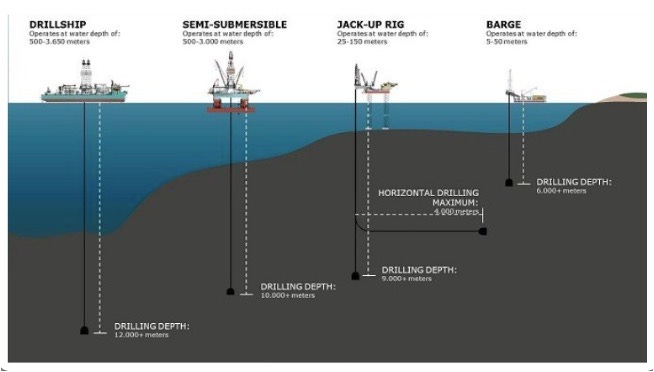

Jack-up Rigs are offshore drilling rigs designed for shallow water operations. They are distinctly different from deepwater semi-submersibles (what most people think of when they think about offshore drilling); while semi-submersible rigs float on the water, jack-up rigs are secured to the sea floor by movable legs that elevate the rig above the surface of the water.

While deepwater drilling is the flashiest and most publicized — using some truly awe-inspiring technology to drill in waters over 4,000 feet deep — shallow water production makes up 65% of offshore oil and gas production globally.

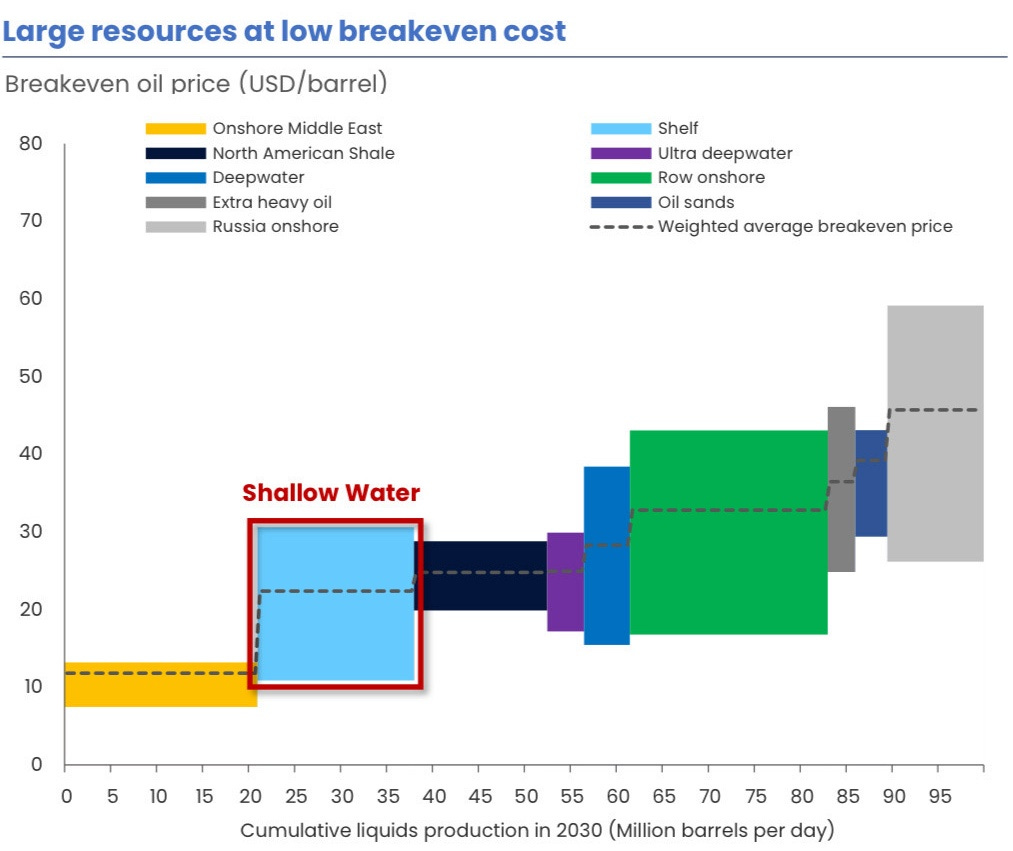

Shallow water drilling also has some of the lowest breakeven costs of any oil and gas production, with average breakeven costs of $20 per barrel, making it a consistently economical resource even during times of high price volatility.

Offshore Oil & Gas Capex Cycle

The offshore oil and gas industry has entered a new development cycle. For the last decade, US shale basins have provided nearly all oil supply growth; these basins are aging, and the same supply growth cannot be expected in perpetuity. Many of the offshore oil and gas resources that are ripe for production were discovered during the last offshore cycle, which ended with the shale revolution; with shale drillers flooding the market with oil, offshore projects began to look uneconomic and were put on hold until the oil price environment improved. While offshore projects have higher capital expenditure requirements and are longer cycle investments, currently undeveloped offshore reserves have some of the lowest break-evens available of any oil projects, with 86% of undeveloped offshore reserves estimated to be profitable a $70/bbl. oil.

Offshore oil & gas expenditure continue to trend upwards, driven in large part by national oil companies (NOCs) like Petrobras (Brazil), which was one of the top three sources of production growth in 2023, and Saudi Aramco (Saudi Arabia), for which offshore production (most of which is found on the coastal shelf) now makes up over 34% of their total production.

The State of the Rig Market

The current order book for new jack-up rigs sits at about 3% of the global fleet, the lowest it has been in 20 years. With the price of a new modern spec jack-up rig reaching $300 million, the current day rates cannot support a reasonable return on investment, Borr projects that, in order to receive a 15% return on investment for a newly built rig, day rates would need to be 40% higher than they currently, roughly $230K/day. Borr’s two new rigs currently under construction were purchased at far lower prices almost three years ago, so those two rigs will operate economically at current day rates when they enter service.

Rig utilization rates continue to increase, with demand for modern rigs like those operated by Borr making up most of that demand.

The global rig fleet is quickly aging, as little investment has been made in new rigs for ten years. With so many rigs aging beyond their useful life and so few new rigs being built, the global fleet will likely see a reduction of more than 100 rigs out of a current global fleet of 497 within the next few years.

With rig utilization already north of 90%, the rig market is already extremely tight; with the retirement of aging rigs likely to remove at least 20% of the total rig supply from the market, it is difficult to overstate how tight the jack-up market currently is. The only pressure release valve for this tight supply-and-demand balance is either an economic cataclysm that puts all new offshore development to a halt or day rates increasing to at least $230K/day.

Day rates move exponentially during every cycle; we believe that due to the structural undersupply in the rig market, the inflection in day rates will be particularly pronounced, and day rates will likely move well above the $230K/day rates required for new build rigs, as oil companies compete with one another to secure contracts for rigs at any price necessary.

Borr Drilling

Borr’s fleet of rigs are also all modern rigs. Modern rigs command the leading-edge day rates because they drill wells faster and more efficiently than older rigs, which is why modern rigs make up 75% of total jack-up rig demand.

The company has the youngest fleet among its competitors, with its rigs averaging only 6 years old. Younger fleets will obviously require lower maintenance capex to keep operational.

Having the youngest fleet and all modern spec rigs allows the company to have best-in-class operating costs; Borr can break even at day rates of only $59K/day, day rates that are only ever seen at the bottom of cycles.

Borr has $1.9 billion in backlog, with 84% of their fleet contracted through 2024 at day rates of $132K/day and 60% of their fleet contracted through 2025 at day rates of $135K/day. This backlog allows for good visibility on revenue for the next couple of years while the remaining portion of its fleet is left to be contracted off the spot market, for which leading-edge day rates are $165K/day. While it may seem that the company should not have contracted such a large portion of its fleet and left it more exposed to the leading-edge day rates on the spot market, we believe that contracting such a significant portion of its fleet was necessary to achieve better interest rates when it refinanced its long-term debt in the Q4 2023.

The company was able to refinance its long-term debt at 10% and push maturities out until 2028; we believe that had it not been for the revenue visibility that the backlog provided, the company would have had to refinance its debt at a much higher interest rate. This refinancing was also crucial because the covenants on the old secured debt prevented the company from implementing any significant capital return to shareholders. This is why, soon after the refinancing, the company announced a new quarterly dividend of $0.05 and a $100 million share buyback program (about 5% of outstanding shares).

Risks

Offshore oil and gas services companies are not long-term buy-and-hold investments; they are objectively terrible businesses; they are highly cyclical, and these cycles are often made all the more violent by extreme over/underinvestment, causing periods of severe deficit and extreme glut. It is telling that almost every offshore services company has gone through bankruptcy at least once. That being said, investing in these companies during the right period in the cycle has the potential to produce outsized gains.

Investments in any offshore driller will be extremely volatile and often trade with a high correlation to the price of oil week-to-week, even though, based on the fundamentals of these businesses, that makes very little sense; offshore oil and gas projects are, at minimum, a 10-year investment, and final investment decisions (FID) on offshore projects are never decided on the week-to-week oscillations in the oil price. If one does not have extremely high conviction about an investment in these companies, it will be very difficult to hold through periods of drawdown.

We believe the only major risk to the investment thesis is that management does not use the majority of free cash flow to de-lever and return capital to shareholders. While this is a risk, we believe that, given the company’s dismal performance during the recent bottom of the cycle, shareholders will continue to keep management on a tight leash, and any risk of capital misallocation will not be feasible until late in the cycle at peak exuberance, when an astute investor will already be exiting their position.

Valuation

Based on our calculations, Borr currently trades at a significant discount to the replacement cost of its rig fleet of over 50%. We believe that by 2027, the company could generate almost $1 billion in free cash flow annually at day rates of $230K/day, which we think is the minimum day rate required for current new build economics. We believe it is very probable that day rates will go beyond this rate, with day rates as high as $250K - $300K/day (roughly the day rate peak of the last cycle) being highly probable.

We believe Borr Drilling could be worth $30 per share by 2027, which would constitute an almost 360% increase in the share price from where the stock is currently trading.

For more information about Berman Capital Group’s investment management services or our research, contact us at info@bermancapitalgroupllc.com or see our website.