Investment Report: Thermal Coal Short

Oversupply in the domestic and seaborne thermal coal market

Summary

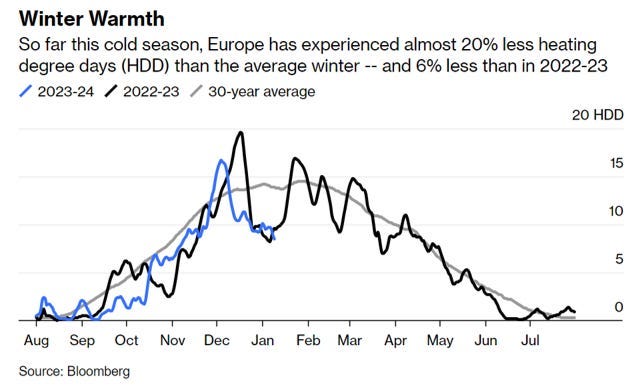

Winter is already over for the thermal coal market. While winter usually drives up the demand for thermal coal due to the need for heating and electricity generation, thermal coal inventories remain high because the first half of this heating season has been so mild. At this point, it would require some drastic winter weather to see anything but an oversupply in the thermal coal market in the United States and Europe. The oversupply of thermal coal in the United States is so substantial that we believe the thermal coal market will remain heavily oversupplied through the winter of 2024-2025.

Berman Capital is short Alliance Resource Partner (ARLP) and Hallador Energy (HNRG), two thermal coal producers that have significant production in the Illinois basin. We believe that at some point in 2024, ARLP will be forced to cut its dividend, as its ability to generate free cash flow beyond the volumes it has contracted in 2024 becomes compromised by an oversupplied thermal coal market. We think HNRG is a company in terminal decline, as the thermal coal they produce will be less and less in demand because utilities are incentivized — both by government regulation and rock-bottom natural gas prices — to decommission coal-fired power plants, replacing them with natural gas-fired power generation.

Natural Gas Storage

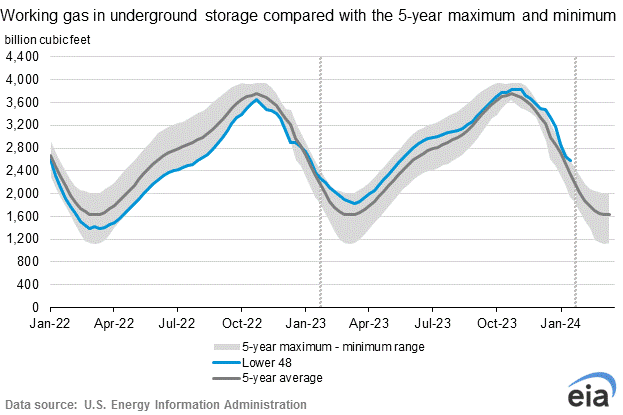

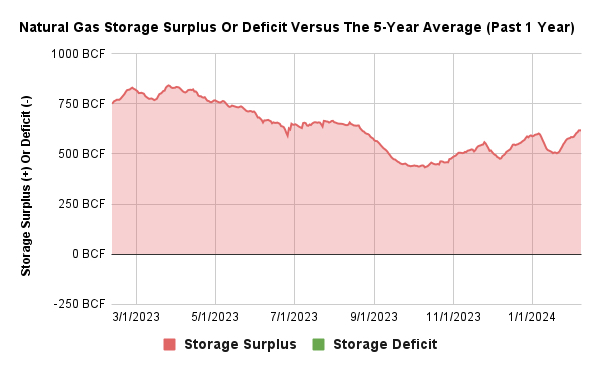

Natural gas storage in the US and Europe sits at extremely high historic levels for this time of year, primarily because of the mild winter both regions have experienced.

In developed economies, natural gas and LNG prices are a major variable in thermal coal demand, and with natural gas trading below $2/MMBtu, natural gas power generation in the United States and Western Europe is cheaper than thermal coal generation, incentivizing a further decrease in coal demand as utilities push back delivery of contracted volumes out into the future. If natural gas prices remain as low as they are for a prolonged period, it will incentivize utilities to invest more in natural gas generation capacity and possibly retire coal generation earlier than planned.

Thermal Coal Demand

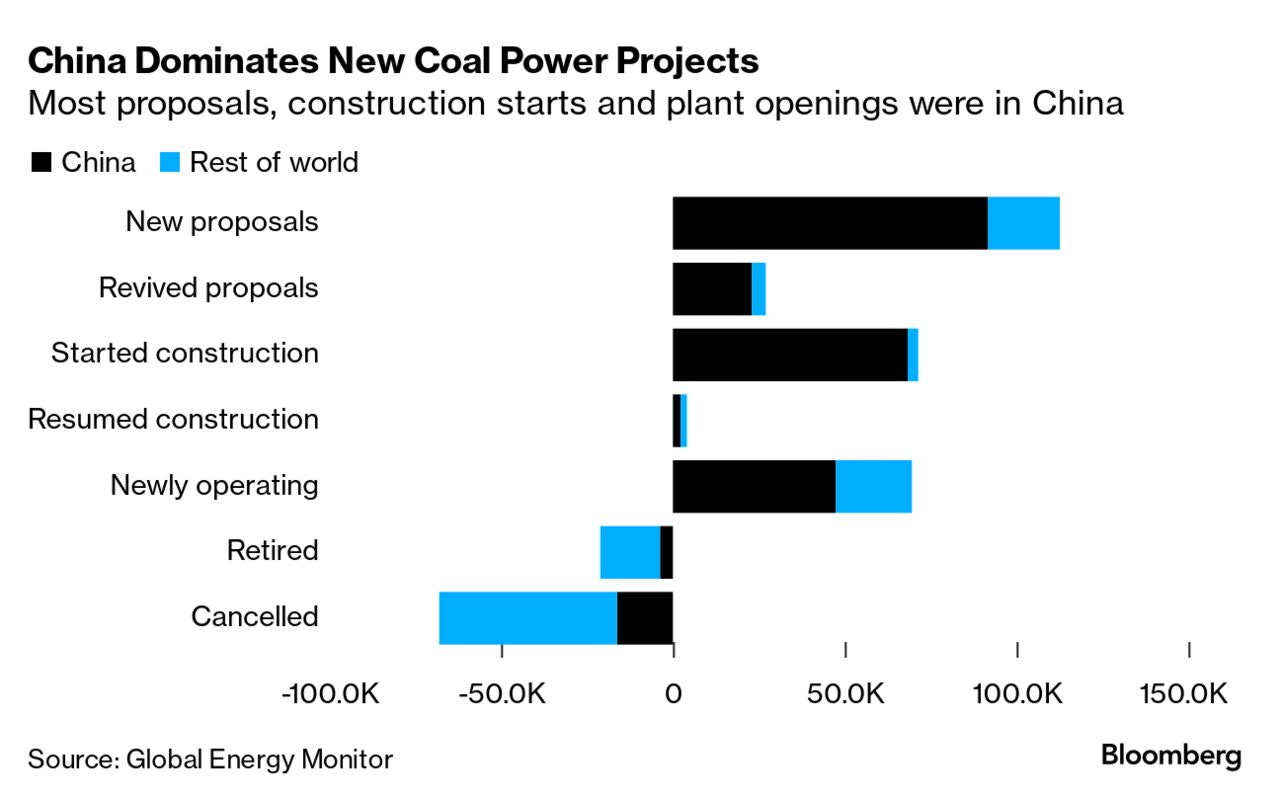

Thermal coal demand is in terminal decline in the United States and most of Western Europe. While we do expect global demand for thermal coal to continue to grow for the foreseeable future, the demand growth will come almost entirely from countries like India and China — which are currently markedly increasing their coal-fired power generation capacity — and the oversupply in global markets is such that any increase in thermal coal demand caused by developing economies will be more than offset.

Coal-fired power plants in the US have continued to be retired and replaced with natural gas power plants. Since 2013, US coal-fired generation has dropped 57.5% from 1,581 TWh to 673.5 TWh. There is another large wave of coal-fired power plant retirements coming in 2025 that will further decrease domestic thermal coal demand, and with natural gas prices testing at all-time lows, it is unlikely that these retirements will be delayed.

Thermal Coal Supply

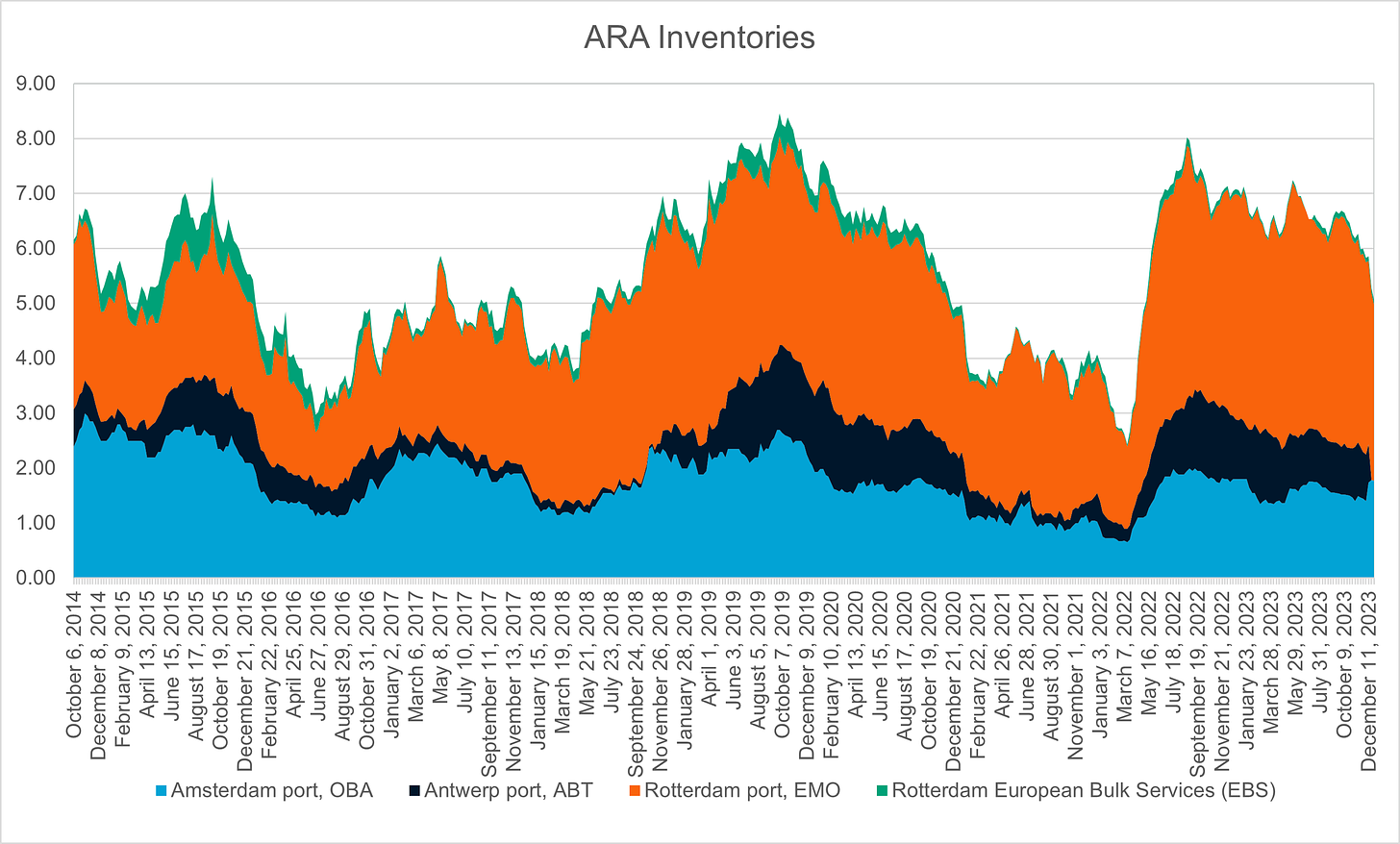

While demand in the US and Europe wanes, supply continues to increase. US domestic utility inventories remain high at 125.1 million tons, which has pushed prices down. Low domestic prices force thermal producers to the export market, primarily the Atlantic basin. However, northern European inventories remain similarly oversupplied, limiting US producers’ ability to find markets for their excess supply.

The thermal coal market for North America and Western Europe is likely to remain heavily oversupplied through the end of this winter and into the winter of 2024/2025, barring some extremely severe winter weather.

Illinois Coal Basin

The Illinois coal basin has a fatal disadvantage to Appalachia in the current supply and demand context: lack of easy access to the seaborne export markets. While many thermal coal producers in the Illinois basin have access to the Ohio River to get some production to the seaborne market, higher transportation costs make it hard to compete with Appalachian producers with easy access to the Atlantic basin. Illinois basin producers are forced to sell most of their production to utilities with coal-fired power plants in the Midwest region, giving them less embedded optionality regarding customers and less pricing power.

The current thermal coal transportation and logistics costs for export to Europe stand at around $45/ton for the Illinois Basin. Based on ARLP Q3 results, Illinois Basin mining and royalty costs are $38.85/ton, which leaves little room for profits, with API2 Rotterdam prices trading below $100/ton, and we think it is very likely that API2 prices continue to trend downwards towards $70/ton as we enter the summer.

Alliance Resource Partners

Company Overview

Alliance Resource Partners (ARLP) is a thermal coal producer operating three mines in Appalachia, four in the Illinois basin, a coal export facility on the Ohio River in Indiana, and a portfolio of coal mineral royalties and oil and gas mineral royalties. The company owns about 65,000 oil net oil and gas royalty acres, which in 2022 produced 2.2 million BOE. Over 50% of the company’s royalty acres are in the Permian Basin, 35% in the Anadarko Basin, 7% in the Williston Basin, and the remaining royalty acres are mostly in the Marcellus and Utica shale plays.

About half of ARLP’s EBITDA comes from its Illinois Basin coal mining operations, 30% comes from Appalachian coal mining operations, 10% comes from its oil and gas royalties segment, 7% comes from coal royalties, and the remainder comes from its New Ventures segment which is comprised on several venture capital type investments, in the energy and mining sector.

Corporate Pivot

Alliance is currently attempting to pivot its business from a thermal coal producer to an oil and gas royalties business; we think this is a necessary long-term strategy for the company as demand for thermal coal in the United States is a declining market, with little in the way of future sustainable growth opportunities, and the company has the opportunity to use the remaining years of cash flow from the thermal coal business to invest heavily in its royalties business.

The oil and gas royalties segment will also take a hit on its ability to generate free cash flow with natural gas prices trading where they are, while further investment in royalties at these prices will almost certainly prove to be a good investment over a three-year period in the short term, these assets will not be able to produce meaningful free cash flow to offset lower thermal coal prices.

Contract Book

While the thermal coal export market operates on long-term supply contracts of fixed volumes at variable prices — often determined by a differential to an index price — the domestic thermal coal industry operates on long-term supply contracts of fixed volumes at fixed prices. Domestic contracts often have price escalators for each contract year; others have re-openers where prices can be renegotiated at certain times. Domestic thermal coal contracts provide coal producers with some revenue predictability but limit the producer's upside when prices rise.

ARLP has 90% of guided sales volumes contracted and priced for 2024, so the cash flow through the end of the year is protected from the current weakness seen in the thermal coal market, but its contract book for 2025 remains wide open. We think it is unlikely that thermal coal prices will recover by the end of the year, and ARLP will be forced to enter new contracts for 2025 and beyond at prices steeply discounted to what they currently enjoy.

Catalyst

With $421.6 million in free cash flow for 2023, ARLP invested $111 million in oil and gas royalties and paid out $365 million in dividends.

We believe that at some time in 2024, ARLP will be forced to cut its dividend to maintain the current rate of investment in oil and gas royalties through 2025. With the prospect of significantly less free cash flow coming in from thermal coal contracts, management will have no choice but to cut the dividend; it will certainly hurt the company’s share price in the short term, but not cutting it would mean sacrificing the company's long-term viability.

Valuation

We believe ARLP shares have a downside of around 42%. We think this valuation is conservative; we do not factor in any production cost inflation on a per-ton basis, which many mining companies continue to see, especially regarding labor expenses; if OPEX continues to increase at the rate it has been, the stock could move significantly lower.

While the company’s revenue cliff is not until 2025, we think management will cut the dividend in 2024 to preserve free cash flow in anticipation of this cliff, and this will act as a catalyst for the stock to rerate lower.

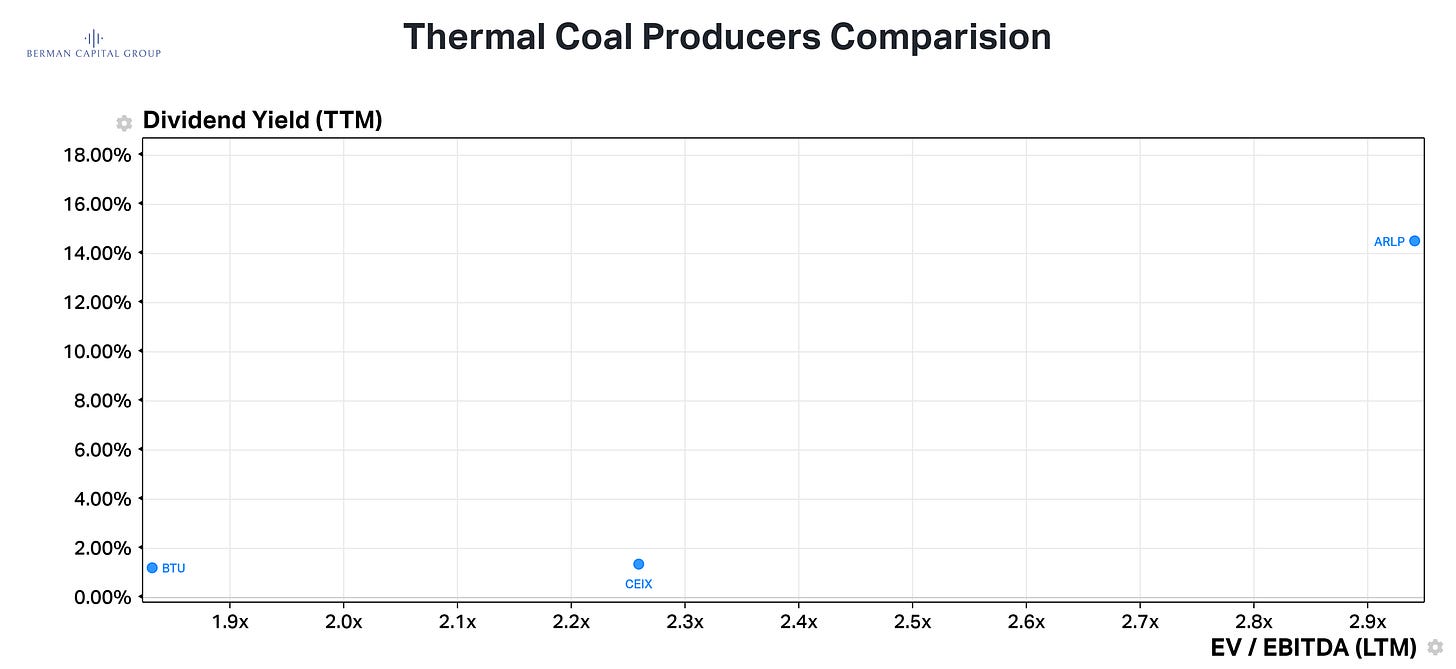

The market valuation of coal mining companies has been based on the return of free cash flow to shareholders, either in the form of dividends or share buybacks.

ARLP’s higher EV/EBITDA relative to other thermal producers is due to its substantially higher return of free cash flow to shareholders; when ARLP cuts its dividend, its multiple will re-rate closer to its peers.

Hallador Energy

Company Overview

Hallador Energy (HNRG) is a small producer of thermal coal in the Illinois basin, with a single coal-fired power plant in Indiana. The company’s coal mining business, Sunrise Coal, produces around 7 million tons of thermal coal per year, 3 million of which is sold to the company’s power plant, while the remainder is sold to utilities in Indiana and Illinois. HNRG operates 4 mines, 2 underground mines in its Oaktown Mining Complex and 2 surface mines. The company’s power generation business, called Hallador Energy Company, operates the Merom Generating plant, and 1080 MW coal-fired power plant located in Indiana. The company also has a 50% interest in Sunrise Energy LLC, a natural gas exploration company operating in Indiana; at current natural gas prices, we assign zero value to this. Hallador has a similar problem to ARLP, a concentrated, declining market with limited to no export capacity.

Constrained Market

HNRG operates in a constrained market, with a concentrated customer base and little to no export optionality. 90% of Sunrise Coal’s revenue comes from 10 power plants run by 5 companies, and 74% of the volume shipped within Indiana. This puts the company at high risk if its core customers idle or retire their coal-fired power plants. These factors give HNRG limited pricing power for negotiating long-term supply contracts with customers, meaning their price realization is substantially worse than their larger competitors and will continue to get worse as the demand for thermal coal in the US continues to decline.

HNRG will experience similar problems to ARLP — a wide-open order book — after its current contracts end. Unlike ARLP, which has some export capacity, HNRG has none, and the company’s price realization on new contracts will decline significantly.

Declining Asset Quality

Hallador’s coal mine assets produce high-sulfur coal and are at the high end of the cost curve, higher sulfur content usually trades at a discount to index prices due to the additional expense post-combustion of reducing sulfur dioxide emissions.

The company has seen its mining costs per ton increase; we think this trend will likely continue despite what management suggests. As of Q3, coal mining operations costs were $48.92 per ton, with the sale price for contracted tons through the end of 2023 averaging $54.3 per ton. Management has chalked up the increase in mining costs to industry-wide inflation and the fact that in Q3, the company moved 4 out of 7 of its mining production units; this suggests to us a declining productivity in their mines; moving that large a percentage of your mining production units does not happen unless you are having production issues.

We believe that it is highly likely that Illinois Basin coal prices will decline to the low $40s, making the company’s power generation business the only cash flow-positive business segment.

Power Generation Business

Hallador Energy Company purchased the Merom power plant in 2021. Before the purchase, the previous owner, Hoosier Energy, planned to decommission the plant.

Ultimately, Hallador’s plan should be to take the free cash flow it can from its declining coal production and invest that into other power plants in the Illinois Basin. This will allow the company to run its coal assets down until it becomes a net buyer of coal and pivots to a power generation company. We think this is likely no longer possible; when the company’s current coal contracts end, cash flow will decline significantly, eliminating the free cash flow they will need for these investments.

We think the power plant will struggle to achieve the price per MWh the company is targeting. Electricity costs will continue to trend downwards, as low natural gas prices and an oversupplied thermal coal market will decrease input costs for power plants and put downward pressure on prices. HNRG only has about a quarter of its generation capacity under fixed-price long-term contracts, so the company remains very exposed to short-term electricity price fluctuations.

Valuation

Despite the attempts by management to diversify the company’s operations, we believe that Hallador is a company in decline. It will continue to see rising production costs at its coal mines and limited free cash flow generation. We think that in the long term HNRG will either be liquidated or will have its assets bought at distressed prices. In the short term, we think the current share price has a downside of at least 50% as details of the contract pricing beyond 2024 become known.

For more information about Berman Capital Group’s investment management services or our research, contact us at info@bermancapitalgroupllc.com or see our website.