Summary

Sable Offshore (SOC) is attempting to restart the Santa Ynez Unit (SYU), a best-in-class low-cost oil and gas asset off the coast of Santa Barbara, California. We believe that the market is undervaluing Sable for understandable reasons. Sable went public via a special purpose acquisition vehicle (SPAC) and is attempting to restart an oil and gas asset in a state notoriously unfriendly to the oil and gas industry, which inherently comes with regulatory legal risk that many find difficult to evaluate.

Situation Overview

The Santa Ynez Unit (SYU) was originally operated by ExxonMobil. The first discoveries of this resource were made in 1968, and production began in 1981, followed by an expansion project that started in 1988, which included the Heritage and Harmony offshore platforms and the onshore processing facility. In May 2015, production was halted due to a leak in a pipeline carrying crude oil produced by the SYU and it has not produced oil and gas since.

Sable Offshore agreed to purchase the Santa Ynez Unit from ExxonMobil when it went public via a reverse merger with Flame Acquisition Corp in February 2024. ExxonMobil provided Sable with a 5-year $643 million term loan to finance the purchase of the SYU. That term loan carries a 10% interest rate and must be refinanced once Sable achieves restart.

This is an incredible deal for Sable. ExxonMobil took a $2.5 billion loss on this asset. This might leave many wondering why Exxon would sell this asset for such a low price in the first place. The answer is that California regulations have made operating in the state difficult for multinational oil and gas producers like ExxonMobil, and for a company that produces 2.5 MMBbl/day, the additional production from the SYU if it is restarted, would be a rounding error for Exxon and not worth the added regulatory burden that would come from operating its last remaining asset in California. Occidental Petroleum made a similar calculus when it spun out California Resource Corp. in 2014. Chevron is also looking to do the same, as it has slowed Capex on its remaining California assets and moved its headquarters from the Bay Area to Houston. There are stipulations in Sable’s purchase agreement with Exxon that if production is not restarted before 2026, Exxon has the right to take back the SYU assets. We think that Exxon does not want these assets back, so if it takes Sable until 2026 to restart production, we believe that Exxon will amend its agreement to extend the time that Sable has to restart production.

Assets Overview

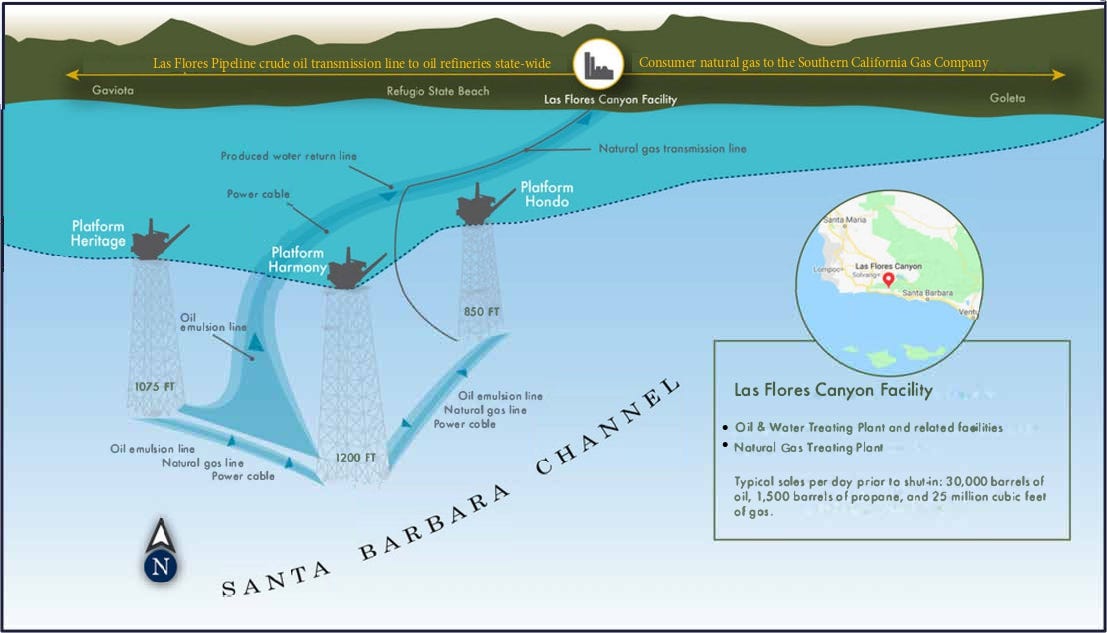

The Santa Ynez Unit comprises three shallow-water offshore platforms made up of 16 federal leases across 76,000 acres and servicing 112 wells. In 2014, the last full year of operation, the SYU produced an average of 27 million cubic feet (MMcf) and 29 thousand barrels (Mbls) of crude oil and condensates per day. Along with the offshore assets, Sable owns the Los Flores onshore processing facility, which includes a crude oil treatment plant, a natural gas processing plant, a co-generation power plant, and a crude oil storage capacity of 540 thousand barrels (Mbbls).

The Santa Ynez field is an outstanding low-cost asset with a low decline rate of only 8% per year with plenty of opportunity to grow production. There are currently 102 identified and undrilled opportunities within the 16 federal leases and opportunities for enhanced oil recovery. Sable plans to make several operational improvements to the SYU, including installing electrical submersible pumps (ESPs), which should further increase production.

Once operational, Sable will also benefit from California's substantially higher natural gas price. Unlike natural gas production in areas like West Texas, where the regional WAHA natural gas hub is regularly negative due to limited pipeline capacity for transport out of the basin, the Southern California natural hub, SoCal City gate, regularly sees pricing north of $3 per MMBtu.

Sable also owns two crude oil pipelines to transport crude oil produced by the SYU. Line 324 is a 10.8-mile pipeline transporting crude oil from the Los Flores station to the Gaviota Pump Station in Santa Barbara County. Line 325 is a 113-mile-long crude oil pipeline that extends from the Gaviota Pump Station to the Pentland Station in Kern County, California.

The Pipeline Leak

In May 2015, line 324, then operated by All American Pipeline L.P., experienced a leak of approximately 2,934 barrels of crude oil, of which about 598 barrels reached Refugio Beach and the Pacific Ocean. The Line 324 leak was relatively minor; each year in the United States, around 76,000 barrels of crude oil are leaked from pipelines, and the Exxon Valdez oil spill was 257,000 barrels. Since the pipeline leak, the SYU and pipelines have suspended production with continued maintenance, so that all the facilities remain in an operationally ready state.

Regulatory Hurdles

The impediment to Sable restarting the SYU is the state regulatory bodies and the County of Santa Barbara. While the State of California has no regulatory authority over the offshore platforms as they are in federal waters, they do have some regulatory oversight over the onshore pipelines. In short, California regulators and the county of Santa Barbara do not want Sable to restart the Santa Ynez field and have been throwing up legal hurdles to this end.

The only significant hurdle remaining for Sable is a dispute with the California Coastal Commission (CCC) regarding whether or not the installation of safety valves on a part of the pipeline within the coastal zone constituted maintenance or required a new permit. We think that according to the 2020 Consent Decree, which dictated the terms under which the pipeline could be restarted and was agreed to by both Federal and California state agencies, the California Coastal Commission has no jurisdiction over the pipeline restart process. According to the consent decree, the CAL Fire Office of the State Fire Marshal (OFSM) has regulatory authority superseding both the county of Santa Barbara and the CCC regarding the pipeline restart. The safety valves Sable had been attempting to install are considered the Coastal Best Available Technology (CBAT) and are required for the restart plan.

As of the 17th of December, the OFSM approved Sable’s implementation of enhanced pipeline integrity standards and granted Sable a state waiver of certain regulatory requirements related to cathodic production and seam weld corrosion for the pipeline. Being granted this waiver was a necessary condition for restarting the pipeline, allowing Sable to now begin hydrostatic testing on the pipeline before restarting production in early 2025.

We believe that most of the regulatory risk is behind Sable. We think Sable has progressed this year from a question of if the restart would happen to when the restart will happen. While the market remains fixated on a restart date in the fourth quarter of 2024, we see it as entirely unimportant if the restart happens in December 2024 or February 2025. Sable worked through the majority of the legal risk associated with the restart of the SYU, yet the market is still pricing in considerable legal risk.

Valuation

We think Sable Offshore’s share price could be $100 within the next three years, an almost 450% increase from today's price. Even at substantially lower crude oil prices, we think Sable's share price offers an extremely attractive risk/reward.

Upon restarting SYU, We think that by 2027, Sable will generate $500 million in free cash flow per year. We believe Sable will quickly be able to pay down its outstanding debt, after which we think that with a limited Capex of around $100 million per year, Sable can increase production with a considerable return on capital and return the remaining free cash flow to shareholders in the form of buybacks and dividends. We also feel that management has incentives aligned with shareholders, as CEO Jim Flores owns over 12% of the company.

For more information about Berman Capital Group’s investment management services or our research, contact us at info@bermancapitalgroupllc.com or see our website.

On June 10th, 2025, Sable's objection to the Coastal Commission's preliminary injunction was rejected by the court. The preliminary injunction stands. The trial date has been set for October 2025.

While the share price sold off 5% on the news, this has not materially changed anything. We continue to believe that this does not prevent Sable from pumping oil through the pipeline, but it does add some legal complexity to certain pipeline maintenance required by the Consent Decree. While there is a stipulation in the Consent Decree for emergency repair work, allowing for unpermitted repair work to be carried out in the event of an emergency that is probably not the best option for Sable. We believe that Sable will likely appeal this ruling to the California Appellate Court.

Legal Updates:

On June 3, 2025, the Environmental Defense Center (EDC) was granted a temporary restraining order (TRO) against the Office of the State Fire Marshal (OSFM), preventing it from issuing Sable its certificate of operation for the Las Flores pipeline.

This TRO is the last-ditch effort by environmentalists to have the pipeline shut down. This case against the OSFM is simply a reiteration of old arguments. If it has to go to trial, we believe the OSFM and Sable will prevail; however, this would likely result in further delays in restarting the pipeline. We believe it is unlikely that Sable will wait until the next hearing date on July 18th to address this matter.

The granting of the TRO against the OSFM, though, creates a jurisdictional problem, which is that the TRO would force the OSFM to violate the Consent Decree (federal law). This would violate the supremacy clause of the US Constitution, which states "...shall be the Supreme law of the land; and the Judges in every State shall be bound thereby, any Thing in the Constitution or Laws of any State to the Contrary notwithstanding."

Sable will likely appeal this TRO to the California Appellate Court, hoping for a fast conclusion to either have the TRO overturned or have the Appellate Court rule that the CA Superior Court is not the correct venue for this issue given that fact that the Consent Decree governing the OSFM's actions in this matter is federal. The OSFM has been granted regulatory authority over the Las Flores pipeline by the Pipeline and Hazardous Materials Safety Administration, a division of the federal Department of Transportation, and, therefore, is operating under federal law.

On June 5th, 2025, Sable filed an objection to the preliminary injunction granted to the CCC, preventing Sable from carrying out any more 'development" on the pipeline.

It argues that the Court reached its decision without considering Sable's supplemental material, which, among other things, included the existing Coastal Development Permit (CDP). The CDP had not previously been entered into evidence at the request of the judge during the hearing on the CCC TRO. Sable argues that without considering all of Sable's supplemental material, a decision on the preliminary injunction can not be made. Similarly to the other ongoing case between the EDC and the OSFM, Sable argues that the preliminary injunction is too broad and does not limit itself to the issues in the CCC cease and desist order. in its current form, it would force Sable to violate the federal Consent Decree "because it seeks to enjoin Plaintiffs from complying with pipeline safety repair and maintenance activities required by federal law." per the Consent Decree.

Because of these recent legal setbacks, Sable announced in its recent 8-K that it is now expecting its first oil sales to start on August 1st. While this is disappointing, Sable has plenty of cash left to hold it over during this delay, especially after what now looks like an exceptionally well-timed equity sale. Ultimately, we believe Sable will prevail in these cases; these are not the most challenging legal arguments that Sable has had to deal with in this long saga. The recent sell-off, following the news has now brought the share price back to its level before the pipeline repair work was completed, presenting an excellent buying opportunity. While the timeline for first oil sales has been pushed back, and the outlook is a little less clear, we think the market is overpricing the current risk associated with these last legal issues.