Fourth Quarter, 2024 Investor Letter

Portfolio review and our thoughts on power demand growth projections.

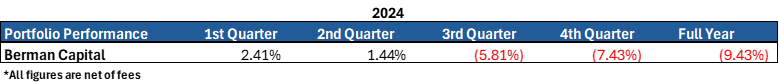

Portfolio Overview & Performance

Berman Capital depreciated by 7.43% in the fourth quarter, bringing our full-year 2024 performance to -9.43%. The second half of the year was particularly challenging for the portfolio. Our corner of the market is currently very much out of favor, with many passive indices tracking our universe of companies seeing double-digit percentage declines in 2024. Furthermore, commodity prices remain relatively range-bound with considerably less volatility than we have seen in recent years. Which limited our opportunities for our futures book that may have otherwise offset the declines in our equity portfolio.

Concerns about the health of the Chinese economy and the time frame for OPEC+ to unwind its production cuts remain headwinds for commodities and will likely remain so for 2025. We think that until these two factors are resolved, there is unlikely to be any sustained broad-based rallies in the commodity sector and we will continue to see the trend of broader dispersion of performance within our investment universe.

Siemens Energy (ENR) continued to be our best-performing position in the fourth quarter, up almost 50%; this brings its 2024 performance to nearly 320%. Our investment memo on Siemens Energy that we published at the beginning of 2024 (link here) won the Savant Investors 2024 Idea Contest. In hindsight, we should have sized our initial position in ENR larger. We believed that the market would likely need multiple quarters of improving fundamentals before realizing the value within the company; ultimately, that was not the case, and we were caught waiting for a pullback in the share price to add to our position, which never came. As of the end of January, we have exited our position in ENR as we think the valuation is now excessively optimistic about the company’s growth prospects.

Our worst-performing position in the fourth quarter was US-based gold miner Idaho Strategic Resources, which was down over 37% due mainly to a sell-off in gold prices caused by a spike in US interest rates following the US election in November. Our investments in offshore oil and gas services continued to be a drag on our portfolio in the fourth quarter, with Borr Drilling (BORR) down 28.57% and Tidewater (TDW) down 25.37%.

Offshore Oil and Gas Services

Offshore oil and gas services have had a rough year, with many stocks in the subsector down 40% or more in the 2nd half of 2024. Our portfolio’s considerable exposure to this sector was a consistent headwind during the 2nd half of the year. Despite that, offshore services remains one of our highest conviction investments over the next three years. We will continue to allocate additional capital to our favorite names, Borr Drilling, Tidewater, and Valaris, at current depressed prices.

The market seems fixated on the murky supply and demand outlook for oil and gas over the next year, but it is important to remember that offshore oil and gas projects have lifetimes measured in decades, and a murky demand outlook over a year is not a factor in the final investment decisions for offshore projects.

Over the last 10 years, shale has been the driver of nearly all supply growth globally, as its short cycle high declines well could be drilled with minimal capital investment compared to offshore development. Shale basins in the United States have become mature resources. While some areas like the Permian Basin in West Texas are still seeing production growth, production in these areas is becoming more heavily weighted towards gas and natural gas liquids, a clear indicator of maturing assets. There may be another million barrels (MMbbls) per day of production growth left in these basins, but we think we are currently seeing a transition period in which the plateauing of production from US shales will cause a new wave of offshore development to meet crude oil demand growth.

At the same time that we expect an increase in demand for offshore services vessels and drilling rigs, there is an inadequate supply of vessels and rigs to meet the demand. There has been minimal capital expenditure on new OSVs and drilling rigs in the last decade due to the lack of demand and corporate bankruptcies caused by the sector's cyclical downturn. This means that old assets that have reached the end of their useful life are being retired without a significant supply of new assets to replace them. Building a new drilling rig or OSV is a multi-year process, leaving a period in which demand for these assets will significantly outstrip the supply. This will cause a 2–3-year period of time in which the operators of these assets will likely produce their current market capitalization in free cash flow.

Thoughts on Our Investment Strategy

Returns in the commodity sector are dispersed a little differently than in the general equities market. While the S&P 500 has historically produced reliable high single-digit percentage to low double-digit percentage gains each year interspersed periodically with significant down years, commodity markets exist almost in reverse. Commodity markets have mediocre performance interspersed with periods of extreme outperformance; those periods often coincide with difficult periods for the rest of the market. This is why we believe an actively managed strategy such as ours is essential for investors seeking exposure to cyclical sectors like commodities and shipping.

Our strategy is not intended to produce consistent market-neutral returns of 15% every year, but while our strategy will be more volatile than a market-neutral approach, we believe it will materially outperform over the full cycle. We specifically look to position our portfolio to take advantage of sector tailwinds, as we believe that in cyclical sectors like commodities, betting against supply and demand fundamentals is a fool's errand. During commodity bull markets, even poorly managed companies with high operating cost assets will see substantial stock price gains. In fact, they sometimes see even better gains than high-quality companies since they are often more leveraged to commodity prices than their well-run peers. During commodity bear markets, the highest-quality companies will see no reprieve from the substantial depreciation in share price suffered by the high-cost operators. We see limited value in betting against the directional tailwind of supply and demand fundamentals. That is why our strategy has the flexibility to be both net long and net short, depending on the opportunity set and where we are in the current cycle.

Due to the concentrated nature of our portfolio and the cyclical sectors in which we invest In some years, such as 2024, our portfolio will have middling returns due to low volatility in commodity markets and a foggy macroeconomic outlook, causing sector-wide declines as generalist capital leaves our sectors. There will also be years in which we will see substantial outperformance due to large-scale imbalances in supply and demand fundamentals.

Artificial Intelligence and Growth Projections in Power Demand

We will preface this by saying we have tried to not discuss artificial intelligence in our investor correspondence to date, mostly because we believe that we do not have any particularly differentiated view on the subject as we are not technology investors. That being said, the implications of artificial intelligence have pervaded so many discussions about energy lately that we felt we must at least briefly address it.

Artificial intelligence and its implications for power demand growth have been a defining theme of 2024, with the expectation that the continued development of energy-intensive large language models will accelerate growth in demand for electricity, an area that has seen anemic growth for the past decade. Perhaps it is our nature to be contrarian, but we are very skeptical of the market fervor surrounding artificial intelligence, particularly the projections for power demand growth being thrown around, which seem a bit fanciful to us.

The current market enthusiasm over artificial intelligence looks to us like a classic bubble eerily similar to the dot-com bubble of the late 1990s. Much like the internet of the late 1990s, artificial intelligence may be the game-changing innovation many think it is, but in its current form, it is unrefined and, so far, has limited economic utility. Much like the dot-com bubble, the suppliers of the picks and shovels of this new revolution have seen the most benefit; in the late 1990s, it was network equipment provider Cisco, and today it is GPU designer Nvidia.

The market buzz surrounding artificial intelligence has also spread to the energy sector. Independent power producers saw impressive gains in 2024; shares in Vistra (VST) and Talen Energy increased 261% and 214%, respectively. Most of these gains were based on the assumption that artificial intelligence will cause a substantial increase in power demand over the next decade, with Vistra projecting 55 gigawatts (GW) of demand from data centers by 2030. The market appears to think that developers of large language models will be unable to make these models more energy-efficient over time.

The power demand growth projections are really a bet on two discrete factors proving out.

What are the odds that artificial intelligence will be every bit as revolutionary as many are projecting it to be and it will come to dominate computing?

What are the odds that we will see no efficiency gains in training large language models despite tens of billions of dollars in investment?

In order for the current valuations of independent power producers to be sustainable, both of these assumptions must prove correct. Even if you assign a probability of over 70% to the first outcome, we think the probability of the second outcome is, at best, 20%. That means there is only a 14% chance that the outcome independent power producers are counting on proves correct. Yet, the current valuations of these companies seem to suggest that the market views it as a near certainty.

The current market frenzy over artificial intelligence seems to be pricing in near certainty for an outcome that is anything but. We are already seeing a slowdown in advancements in artificial intelligence; gains in functionality have become more incremental. It could be that we are simply seeing development bump up against a temporary limitation of computing power, or it could be that the scaling laws are breaking down and that we have reached the limits of what is possible with our current techniques for training large language models.

We are not necessarily calling a top to this market. Historically, we are not particularly good at that and artificial intelligence may be the revolution in computing on par with the internet that many think it is. But this market certainly is a bubble that will pop at some point, and with valuations for independent power producers where they are, we think it will only require marginal revisions to demand growth projections to see share prices decline 40% or more. There is also the risk that a selloff could spread and impact nuclear energy companies, natural gas producers, and natural gas midstream companies as well.

Our current base case is that much of the to-date announced investment in artificial intelligence infrastructure will be substantially curtailed. But if the announced capex of hundreds of billions of dollars is spent on new data centers and Nvidia GPUs to train these AI models, we fear that it could turn out much like the fiber-optic overcapacity seen in the early 2000s.

For more information about Berman Capital Group’s investment management services or our research, contact us at info@bermancapitalgroupllc.com or see our website.