Event Driven Short: YPF S.A.

The exuberance in YPF shares is unfounded as the new Argentinian government has political constraints that will limit its ability to make effective reforms.

Summary

After the recent Argentinian election win by Javier Milei, US-listed shares in YPF S.A. gained over 70%. We believe this enthusiasm is unjustified due to the political constraints Milei and his Libertad Avanza party face. Milei has stated his intent to re-privatize YPF, but he will have little chance of doing so because his party does not have the two-thirds majority needed by the Argentine legislature. We believe the most likely outcome for Milei’s presidency will be similar to that of Mauricio Macri, the former president from 2015 to 2019, who entered office with the promise of economic reform only to be stymied by the Peronist coalition.

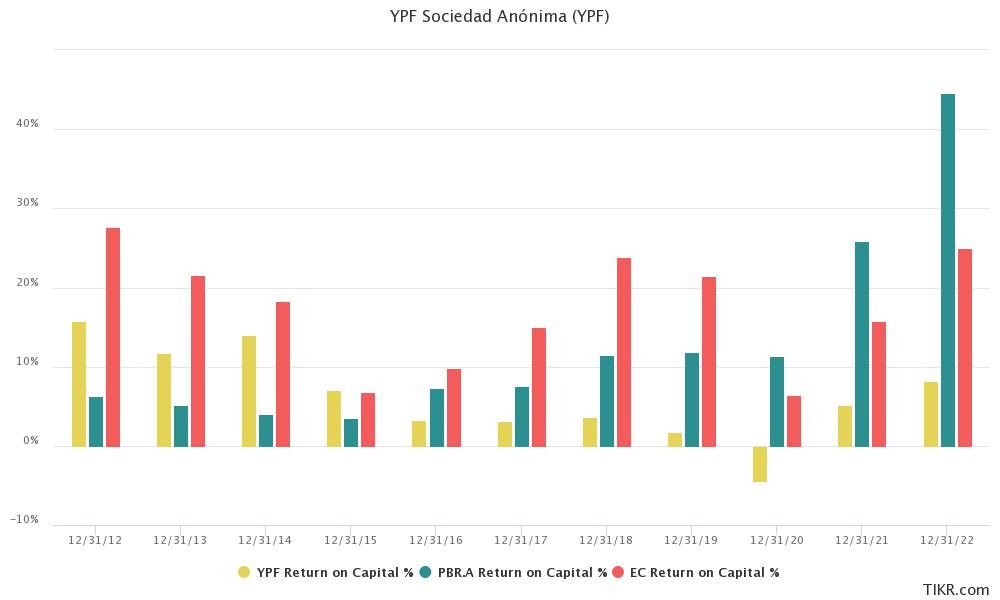

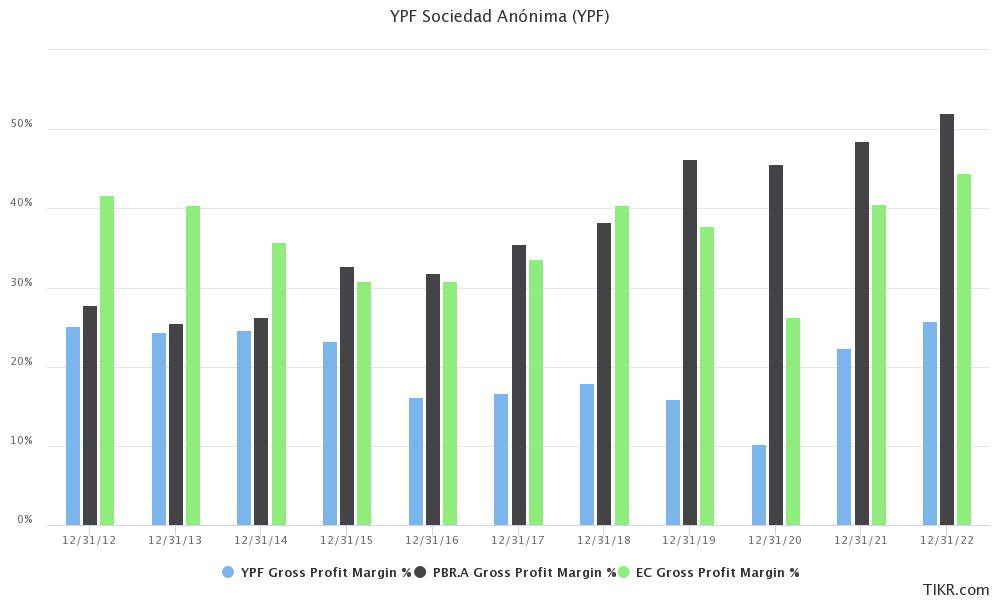

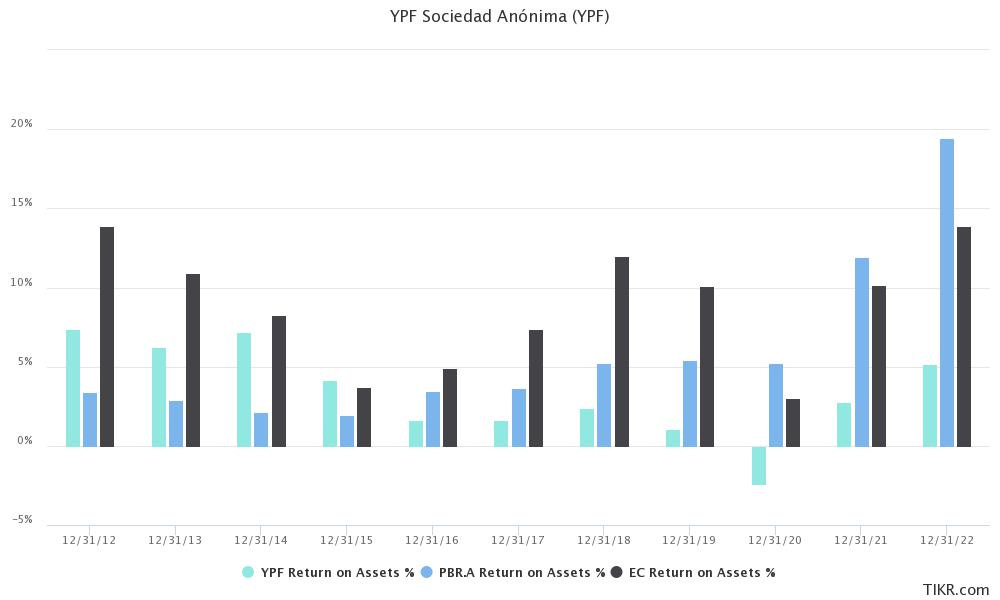

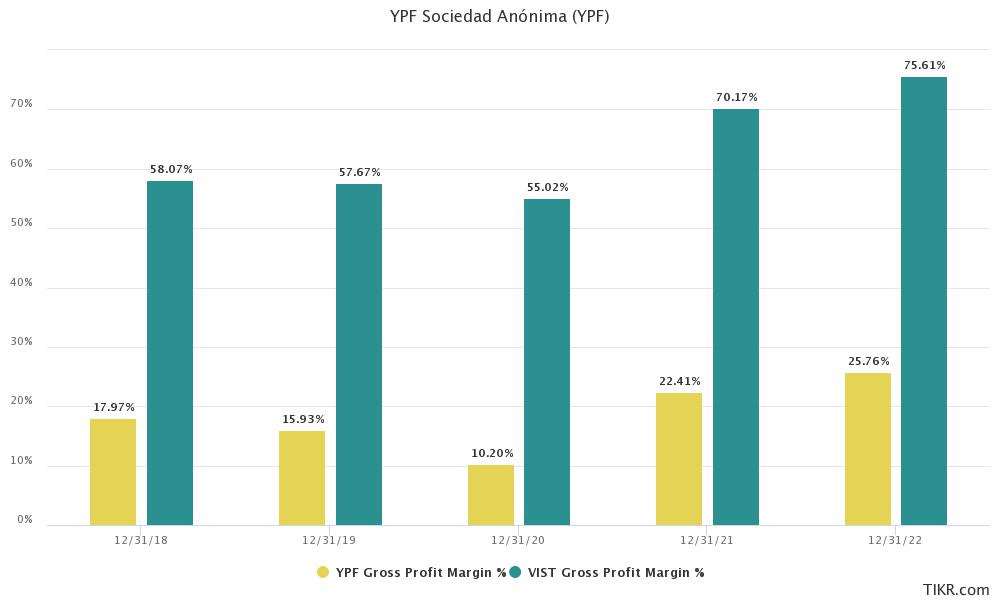

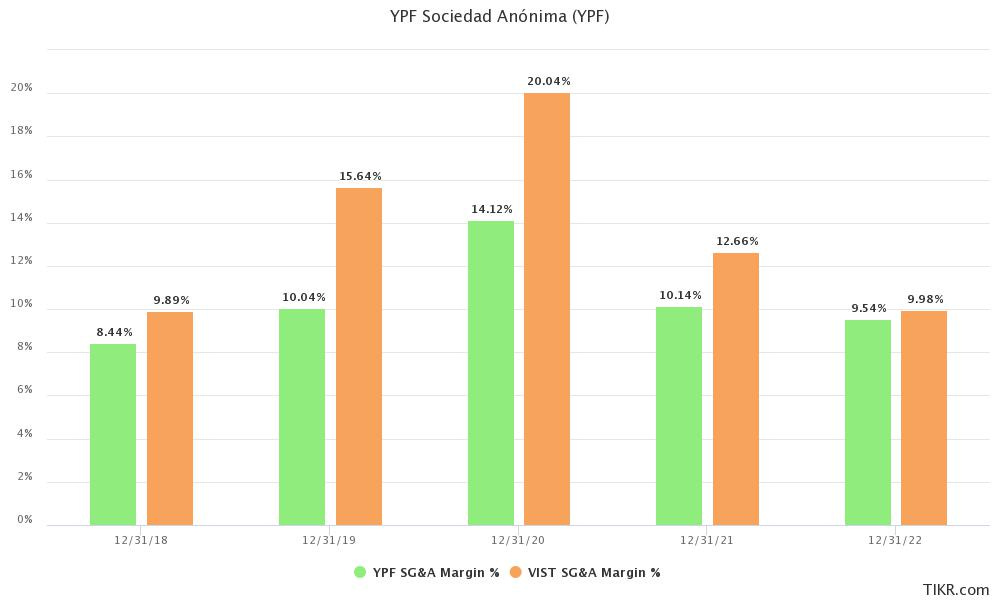

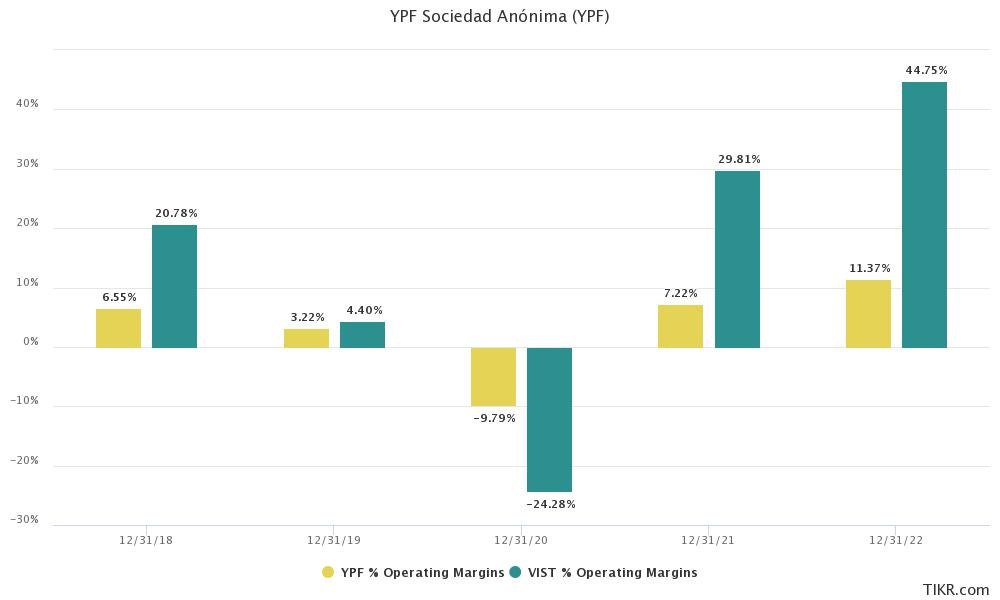

Compared to other producers in the Vaca Muerte, YPF still underperforms, proving that it is not the higher-cost Vaca Muerte basin causing the performance disparity. Vista Energy (NYSE: VIST) is a much smaller and fast-growing company and does not have the midstream and downstream assets that YPF does; this increases the volatility of their performance, but Vista Energy still has consistently higher margins than YPF. Part of this disparity is explained by the fact that Vista Energy exports most of its crude oil production to the international market, where they are not subject to the Argentinian government’s price controls, although its natural gas production is sold domestically.

These price controls on crude and refined products have been a critical driver of YPF’s underperformance. In August 2023, the Argentinian government froze the domestic crude oil prices at $56 per barrel in a misguided attempt to control inflation (link here). These price controls have predictably led to a national supply shortage of gasoline (link here). Without major changes, both in company management and regulatory regime, it is likely that YPF will continue to underperform its peers.

Peronism

In short, Peronism is the cause of the shambolic state of the Argentine economy. Peronism is a political ideology based on the legacy of Argentina’s former president/dictator Juan Perón, that borrows bits and pieces from other political and economic ideologies. Peronism does not have any particularly coherent policy pillars but can best be described as a left-leaning movement with aspects of socialism, nationalism, and populism. Part of the staying power of this political movement has been that because the pillars of the ideology lack any real coherence, it has attracted the support of some desperate groups within Argentina, positioning the ideology to be all things to all people.

When one attempts to govern a country with such an incoherent ideology as Peronism, things quickly go off the rails. Argentina is currently dealing with an inflation rate running at a 143% annual rate (link here), and the Argentine Peso is trading on the black market at one of the lowest levels ever against the dollar. Peronism will always be a cancer upon Argentina, a country that, if it could be governed properly, has the natural resource building blocks to be an economic power on par with Brazil.

Milei’s Political Constraints

While Milei won the presidency, his party, Libertad Avanza, holds only 39 seats out of a total of 257 in Argentina’s lower house (The Chamber of Deputies), and only 8 out of 72 seats in the Senate (link here). In order to privatize YPF, Milei will need a two-thirds majority in the lower house, something he is unlikely to achieve, even with the support of The Juntos por el Cambio (JxC) party voting with Milei, which they will likely do on certain government reforms. Milei’s administration will also be unlikely to receive any votes from the Peronist Unión por la Patria party. The renationalization of YPF was a political success for Cristina Fernández de Kirchner’s presidency. For the Peronist coalition, voting to privatize YPF would be admitting that they were wrong and that nationalizing the company in the first place was a mistake.

The problem for Milei is that while the Argentinian economy would certainly benefit in the long run from these economic reforms (removing price and foreign exchange controls), it would cause economic pain in the short run, which could cost him his political support before his reforms bear fruit. It could come to pass that this will be the turning point for Argentina, allowing their economy to become what Brazil’s was in the 1990s, but Argentina has made a habit out of crushing optimists’ dreams that this country can be anything but an economic basketcase.

We see it as the most likely outcome that Javier Milei’s presidency will look much like that of Mauricio Macri, the former president from 2015 to 2019; Macri entered office with the promise of economic reform only to be stymied by the Peronist coalition. Milei will try to implement his economic reforms, but ultimately, the average Argentinian will not be willing to stomach the necessary economic pain that will come with getting this economy back on track. We think Milei will only be able to partially implement his reforms, which will cause economic hardship in the short run without economic benefit in the long run.

Portfolio Positioning

We believe that it is likely YPF will not be privatized in the next two years, and Milei’s economic reforms will be stymied by the Peronist-controlled legislature and the provincial governments. In this case, YPF will continue to underperform relative to its peers. Berman Capital has shorted NYSE-traded shares of YPF S.A. We think YPF shares will likely fall back to around their pre-election results price of $10.50 per share.

For more information about Berman Capital Group’s investment management services or our research, contact us at info@bermancapitalgroupllc.com or see our website.