Berman Capital Investor Letter - 3rd Quarter 2024

Portfolio Performance, Our Commentary on the State of the Crude Oil Market, and Our Thoughts on the Chinese Economy.

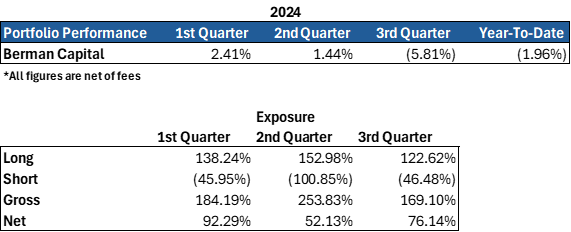

Portfolio Performance

For the third quarter of this year, Berman Capital produced a return of -5.81% net of fees, bringing our year-to-date performance to -1.96% net of fees.

Our best-performing equity position was again our long investment in Siemens Energy, which, during the third quarter, returned 36.88%, as well as several short positions in US oil and gas producers and oilfield services companies, which helped to stabilize our performance in what was otherwise a tough quarter for the oil and gas names in our portfolio.

Our worst-performing equity positions were our long investments in Tidewater and Borr Drilling, with shares of Tidewater down over 21% in the third quarter and Borr Drilling down 10.83%. The entire offshore oil and gas services sector had a challenging quarter, in sympathy with crude oil prices. The longstanding correlation between offshore oil and gas services and the crude oil price has never made much sense, as the quarterly oscillations in crude oil prices have very little bearing on the final investment decisions for long-life offshore oil and gas projects that intend to operate for decades, but that correlation has held through the third quarter and will likely continue.

Clean Energy & Lithium

One of our short books' highest returning investments this year has been our short on a basket of clean energy and lithium miner names. We initially used this basket approach due to two factors, the first being how overpriced we saw the entire sector and the second being our concern was that individual companies within the sector would see meaningful share price appreciation if they received large grants or loans from the US government as part of the Inflation Reduction Act. We felt that we could not adequately gauge the likelihood that an individual company would receive one of these grants.

This strategy has worked exceptionally well as our investment thesis was proven correct that the market was pricing in a growth trajectory in demand for clean energy technology and lithium that was wholly unrealistic, and Chinese overproduction would leave the market in oversupply.

Late in the third quarter, clean energy and lithium miners share prices began to spike aggressively, likely based on the expectation that Chinese stimulus and US fed rate cuts will be beneficial for the sector. This recent price spike has caused us to reevaluate our approach to these shorts. While our basket approach to shorting these names has performed well, several developments in lithium markets, including a decision by Contemporary Amperex Technology Ltd. (CATL) to curtail production at a large lepidolite mine, have led us to the conclusion that lithium prices have likely bottomed. Although prices may have reached a floor, we remain skeptical of the bull thesis for lithium as we still see demand side headwinds that will persist for several years, which will likely keep lithium prices low for the foreseeable future.

We have now transitioned from our basket approach to shorting lithium names to shorting the weakest names within the complex, as we believe that lithium prices are not due to rise significantly, and while the lowest cost producers’ share prices have likely bottomed, there are several overleveraged or high-cost producers that will fare much worse in this low-price environment.

We have taken a similar approach to our shorts on clean energy companies. We have transitioned our basket of names to short positions on a small selection of companies in the weakest subsector of clean energy, mainly solar manufacturing, geothermal, and hydrogen fuel technologies.

Crude Oil

Our investments in crude oil were the culprits for the majority of our underperformance during the third quarter, through our position in futures and our equity investment in energy companies. We misread the extent of the market's negative sentiment for crude oil. Market sentiment became so negative that Brent futures saw for the first time on record negative net speculative positioning, in which the total short positions on Brent futures outnumbered the total long positions.

During the third quarter, Brent crude oil prices fell over 17% on fears that demand from China would remain low into next year due to China’s current economic malaise and that OPEC+ would begin unwinding its voluntary production cuts, causing the market in 2025 to become oversupplied. These are extremely valid concerns, and it is likely that if OPEC+ does not further extend these cuts when they meet again in December, the crude oil market will likely tip into oversupply.

However, the supply and demand balances through the end of the year appear reasonably tight; commercial inventories were low, and we began to see draws from commercial inventories during months in which we historically see builds in inventories due to refinery maintenance season. Our thesis, as we detailed in our second-quarter investor letter, was that crude oil would rally through the end of the year on tight supply and demand balances before prices began falling off at the beginning of 2025 as OPEC+ unwound its production cuts. We believed the market was underpricing the supply tightness at the front of the futures curve.

We were correct on the supply and demand fundamentals but completely misread the market sentiment. In the future, we will be more cautious when trading markets during periods in which the price action is dominated by news flow and not supply and demand fundamentals.

Oil Market Scenario Planning

The crude oil markets are currently at an inflection point where we see several possible scenarios playing out over the next 12 months that all seem equally possible. Usually, one scenario would stand out as the highest probability outcome, but currently we see two scenarios that are diametrically opposed to one another that we think have very similar probabilities. The critical variable for our two scenarios is the decision made by OPEC+ regarding their production cuts.

Scenario 1:

OPEC+ extends its production cuts again when it meets in December, likely only extending by a quarter or even a month at a time, but with the ultimate aim of extending the cuts into at least the second half of 2025.

This strategy would buy time in the hopes that demand to catch up to supply, at the risk of fraying relations within OPEC+, likely increasing the chances of an OPEC price war developing as some members are reluctant to continue with the production cuts. This would keep the crude oil market trading in a similar news flow-dominated dynamic we saw in the third quarter. The problem for OPEC+ in this scenario is where the demand growth will come from. There is a chance that continued Chinese stimulus measures will pick the Chinese economy out of its malaise, and we could see a sizable acceleration in demand, but that is far from a certainty.

Non-OPEC production growth will also continue to be a problem for OPEC+. Unless demand growth sees rapid acceleration, for which non-OPEC supply growth cannot match, it seems likely that any marginal demand growth will be filled by non-OPEC production, leaving OPEC+ in the same conundrum at the end of 2025 that they currently find themselves in.

Scenario 2:

OPEC+ goes ahead with unwinding the production cuts when it meets in December, with a ~180 kpbd increase in production each month for twelve months, eventually unwinding ~2.2MMbpd of production cuts by the end of 2025. This would put the global crude oil market into a substantial oversupply. If OPEC+ announces in December that they are going ahead with unwinding the production cuts, crude oil prices will undoubtedly see significant declines.

However, we think the price declines would have some impacts that market commentators are not factoring in enough. With the cost inflation of the last three years for US crude producers, we think the market is underestimating the amount of North American unconventional crude oil production that will be unprofitable at or below $50 per barrel. We would see a period of contracting non-OPEC production, ultimately leaving the crude oil market far healthier than it has been for some time. The crude oil markets have been at the mercy of OPEC+ for some time now, and the longer these production cuts drag on, the higher the chance of a price war among fractious OPEC+ members.

Wildcard Scenario:

Tensions between Israel and Iran continue to escalate, eventually leading to Israel bombing critical Iranian oil infrastructure. This scenario would likely lead to some kind of escalation by Iran in the Persian Gulf, limiting oil exports from Gulf states in an attempt to cause global economic pain and a more significant push for the cessation of hostilities by countries like the United States. We think this is a low-probability outcome, but this would completely upend the supply and demand calculus for the crude oil market.

We think scenario 1 is slightly more likely; it makes sense for OPEC+ to kick the can down the road for a bit longer, given the possibility of renewed Chinese demand growth, which could make for an easier environment to unwind production cuts at the end of 2025. However, the politics within OPEC+ are fickle. In either scenario, we think there is a high probability that the crude oil market will be meaningfully oversupplied at some point within the next 6 to 18 months.

Chinese Stimulus

The weakness of the Chinese economy has been one of the overriding concerns in the commodities markets this year, as for the last 20 years China has been the driver in global demand growth for all commodities.

In late September, the Chinese central bank announced a raft of new stimulus measures intended to stem the weakness in the Chinese economy. In the initial announcement on September 24th, the People’s Bank of China (PBOC) reduced its short-term reverse repo rate (akin to the US Federal Reserve’s fed funds rate), cut the reserve requirements for Chinese banks, and announced at least 500 billion yuan of liquidity support for Chinese equities, including a swap facility allowing corporations to draw from the PBOC to purchases shares.

We think these measures have yet to address the source of the Chinese economy’s current malaise, which is underwhelming consumer spending, and that more stimulus measures targeting consumer spending will be necessary in the future, but, ultimately, the actual substance of these announcements is of minimal importance. More importantly, the stimulus announcement marks a pivot in post-COVID Chinese economic policy, in which the Chinese Communist Party (CCP) has been reluctant to unleash economic stimulus. The Chinese economy is at risk of seeing a deflationary spiral akin to the one experienced by the Japanese economy in the 1990s, which led to 30 years of economic stagnation and this is likely just the beginning of major economic stimulus measures that will be rolled out over the next year.

The announced stimulus measure thus far will have a limited impact on commodity demand. We do not think it is likely that the Chinese government will employ the massive infrastructure spending of the type we have seen in the past. This era of stimulus measures will be focused on improving balance sheets and increasing consumer spending.

Commodities most dependent on Chinese construction, like iron ore, will likely not see any significant demand growth due to these stimulus measures. The housing stock in China has been overbuilt, and we are unlikely to see anything close to the frenzy in construction we have seen from previous stimulus. The PBOC has announced it will cover 100% of loans to local governments buying unfinished homes, so there may be some marginal increase in demand for commodities like copper from these building completions, but that increase would be marginal at best and unlikely to impact supply and demand in any meaningful way.

The Chinese economy will likely remain a drag on the commodity complex for the foreseeable future. We think the Chinese economy has likely seen the bottom of this recession, but how long the recovery will take is still a major question.

Our base case is that the Chinese economy will not be the engine of commodity demand growth going forward; it will begin to see a slower growth rate as it reaches middle-income status. We think the next engine of economic growth will be India, but we may see a period of low global demand growth in the interim before the Indian economy becomes the driving source of growth. This will likely mean that the commodity complex will be a difficult corner of the market during this period, with a high dispersion of outcomes among companies based more on cost efficiency than leverage to the underlying commodity price.

For more information about Berman Capital Group’s investment management services or our research, contact us at info@bermancapitalgroupllc.com or see our website.